Many Americans worry about whether they are eligible for a federal income tax exemption or if they must pay. Don’t worry, your Miami Tax Accountants, SDG Accountants, can assist you with a team of highly skilled tax advisors! Read this article to learn how to be exempt from federal tax withholding and if you qualify for an exemption.

What is Exempt from Federal Tax Withholding?

When you receive a paycheck from your employer, the business is required by law to deduct taxes and other deductions as directed by the government. One of these deductions is withholding, which is the amount that your employer is required to deduct from your paycheck for federal income tax purposes. You’ll usually notice this on your paystubs as well; there’s a section on your paystub that shows you how much federal income tax was deducted. Always go over your paystubs thoroughly and analyze every deduction you’ve made. Keep in mind that exemption excludes the Federal Insurance Contributions Act (FICA), as well as Medicare and Social Security. You will have to pay those taxes on every paycheck.

Let’s have a look at how refunds work. When tax season arrives, you review your paystubs and financial records to determine how much tax, or “income tax liability,” you owe for the year. Once you’ve determined your amount, compare it to the amount withheld by the government from your pay for the year. You obtain a refund if the amount on your paystubs is larger than the amount you calculated; otherwise, you must pay the remaining debt owed. You will see withheld taxes for state tax purposes on your pay stubs, and your refund will be calculated in the same way.

Both the government and the taxpayer benefit from withholding. For the government, withholding taxes ensures that the taxpayer does not avoid paying taxes and that the tax bill is paid on time each year. For the taxpayer, it decreases the amount of worry they will experience while filing their taxes because withholding lowers their annual tax payment by a certain amount. Individuals may find it difficult to manage and pay all of the money at once.

How does Exempt from Federal Tax Withholding Work?

You must verify a few things in order to be exempt from withholding. When you declare yourself exempt from federal withholding taxes, the government will not deduct any taxes from your paychecks. This isn’t something you can just claim; the IRS requires a few verifications before you may be exempt from federal income taxes. If you owe no federal income taxes the previous year and plan to owe no federal income taxes this year, you can qualify for an exemption.

How to Claim Exempt Status?

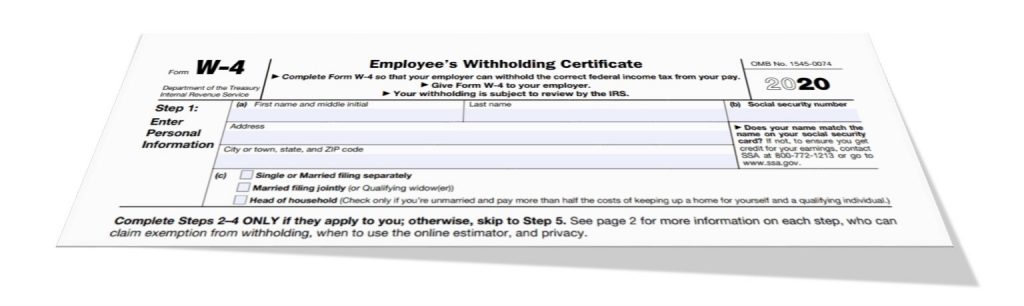

The IRS has provided taxpayers with a W-4 form that they can use anytime they change jobs or need to adjust their withholding amount. This form is completed by the employer and instructs them on how much to deduct from each paycheck. You can claim up to three allowances on the W-4 form. Your company will deduct less from your salary if you claim fewer allowances. To file a complete exemption, write exempt in the space below Step 4(c) on the W-4 form. To learn more about the W-4 form and how to file one, contact your Tax Preparer Miami.

Some taxpayers desire to claim exempt status for a limited time and then return to it later. It is possible to do so, and many taxpayers do so throughout the year. When you want to claim exemption, you must once again file a Form W-4. Your tax bill will not be postponed as a result of this; the amount owed will be paid during tax season. Fill out a new Form W-4 to resume withholding federal tax. It’s important to understand whether you’re eligible for withholding so you don’t end up paying fines if something goes wrong.

Filing as Exempt When I am Not Eligible:

Remember that filing an exemption does not reduce your taxes; rather, it causes you to pay your entire tax amount when filing your federal income tax. The IRS can levy fines for failing to withhold federal taxes in particular situations. Contact an experienced tax professional to ensure you fully understand the exemption and whether or not you are eligible.