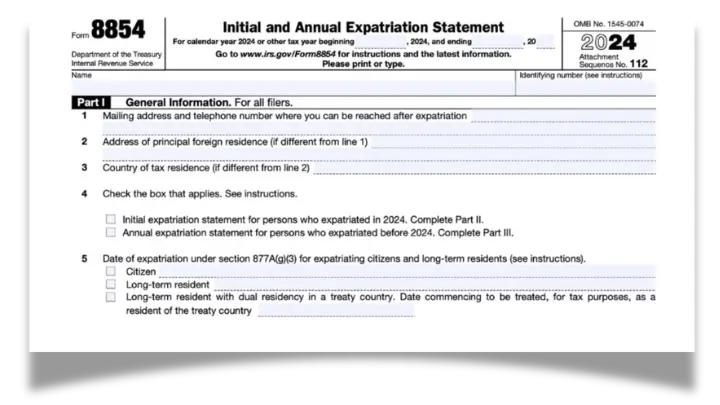

In order to renounce your US citizenship, you are required to submit several forms. One of the vital forms that needs to be submitted is IRS Form 8854. Until you have submitted this form, the Internal Revenue Service will still regard you as a citizen of the United States.

In this article, we will explore in detail the particulars of Form 8854, who qualifies to submit it, and who stands to gain the most from it.

What Exactly Is Form 8854?

Form 8854 is an IRS tax document that is meant to declare one’s U.S. taxes settled once and for all. Until you provide proof that you’ve settled all your dues, the government will continue to regard you as a citizen for tax remittance purposes and expect you to submit taxes regularly.

In the same way, Form 8854 also decides whether you fall within the category of a covered or non-covered expat. If you fall under the covered expat category, you will also need to pay an exit tax as part of your declaratory renunciation.

Who Needs to Submit IRS Form 8854?

Form 8854 must be filled out by U.S. citizens planning to renounce their citizenship. Some long-term residents also need to submit this form when they stop being residents of the United States. More specifically, U.S. residents who have maintained a Green Card for at least eight years out of the last fifteen must complete Form 8854 if they wish to be classified as non-residents.

✅ Form 8854 IS Required If…

A resident alien (typically a green card holder) must file Form 8854 if:

- Gave up their green card, or had it administratively or judicially revoked or abandoned (e.g., filed Form I-407 with USCIS).

- They are a “long-term resident” (i.e., held a green card in at least 8 of the last 15 tax years), and they have officially expatriated — meaning they either:

- This falls under the expatriation tax rules (IRC §877A) and triggers a requirement to file Form 8854, which is a statement of expatriation and a net worth/income/assets disclosure.

❌ Form 8854 Is NOT Required If…

A resident alien leaves the U.S. temporarily or gives up their U.S. residency without meeting the “long-term resident” definition. Specifically:

- You are not a green card holder (e.g., on a work visa like H1B), or

- You’ve had a green card for less than 8 out of the last 15 years, or

- You just leave the U.S. and don’t officially abandon your green card.

- In these cases, Form 8854 is not required.

What Is a Covered Expatriate?

Deciding whether you are a covered or non-covered expat will significantly affect the costs you incur in renouncing your citizenship. In reality, this single determination may drive your finances, determining if renouncing your citizenship is worthwhile at all.

What, then, is the distinction between a covered and non-covered expat? Simply put, covered expats must pay an exit tax when they renounce or terminate their citizenship, while non-covered expats do not.

Who Is Considered a Covered Expatriate?

A covered expatriate is someone who the IRS considers as any of the following standards:

- Net Worth Test: Your net worth is more than $2 million during expatriation.

- Tax Liability Test: Your yearly average income tax liability for the last five years crosses a particular figure.

- The figure is set at $190,000 (adjusted for inflation every year) for the 2024 filing date.

- If you can prove the above conditions, you will be compelled to pay the exit tax, which affects covered expatriates who give up citizenship or conditional expatriate residency.

- You haven’t filed or paid your taxes in any of the last five years.

In any of the above circumstances, you are a covered expat and will incur an exit tax. If not, you are a non-covered expat, and the exit tax does not apply to you. In both situations, you must file Form 8854 to determine whether you are covered or noncovered.

Never had a pro tax help before?

Get the best advice from our experts

What is the Method for Avoiding the Exit Tax?

Suppose you expatriate as a covered expatriate in the same year you expatriated. In that case, you will incur an income tax liability on the net unrealized asset value (NUA) of your property at the applicable income tax rate on unrealized gains. This assumes the property was disposed of at FMV on the day before the expatriation. As a fundamental taxation principle for non-citizens (expatriates), it is presumed to occur on the day before the date of expatriation.

In other countries, this is commonly known as the “exit tax.”

But there are exceptions for dual citizens and certain minors:

- One of the prerequisites for dual citizens is that they must have become US citizens and citizens of another country at birth. Upon expatriation, they must continue to be a citizen and tax resident of this other country.

- Certain minors will qualify for the exception if they expatriated before the age of 18 ½ and were not residents of the U.S. for 10 years before expatriating.

Penalties for Failing to File IRS Form 8854

Failing to file Form 8854 when required can result in a $10,000 penalty and potential ongoing tax consequences under the expatriation rules.

The total cost for failing to submit a Form 8854 can be extreme. The first penalty is the noncompliance penalty, which is set at $10,000. (This only applies to covered expats.)

On top of this, assuming you do not submit Form 8854, you will be regarded as an American citizen and, as such, will remain bound to US citizenship-based taxation. This entails being liable for taxes incurred before filing, along with interest and fines attached for the delay.

It does not matter if you are labeled as a covered or non-covered expat; the ideal approach is always to submit this form as required.

Instructions to Complete and Submit Form 8854

Completing Form 8854 comes with unique challenges. For such reason, we do not recommend attempting to fill out this specific form yourself due to potential consequences such as penalties for making even the slightest of errors and miscalculations.

Consider the Case: if you wish not to be deemed a covered expat, you need to attest on Form 8854 that you have been fully compliant with the tax obligations for the last five years – this is something that poses a risk of contention and comes with substantial penalties if the taxpayer is erroneous.

Our best advice for safeguarding your interests is to seek a U.S. Expat Tax advisor like the SDG Accountants and file IRS Form 8854 with precision for security and peace of mind.

🔁 What to File Instead (if applicable):

If the individual is not filing 8854 but is ending U.S. tax residency, they may need to:

- File a dual-status return for the year of departure (Form 1040 + 1040-NR),

- Attach a residency termination statement,

- Possibly file Form 8840 (closer connection), or

- Maintain records for Form 8833 if taking a treaty position.

Still Have Questions about IRS Form 8854 and Your Expat Taxes?

We hope this post has helped you understand what Form 8854 means to you as a U.S. expat.

Contact us, and one of our Miami Tax Accountant will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.