Have you lately migrated to another country for business? If you answered yes, you are now officially a US expat. Living overseas for professional reasons can be a significant shift in terms of both physical and mental health, but it also has tax implications. Many expat business owners are unsure how to handle their taxes after relocating. This article will discuss the tax obligations of an expat business owner, with a particular emphasis on Form 5471 and its requirements.

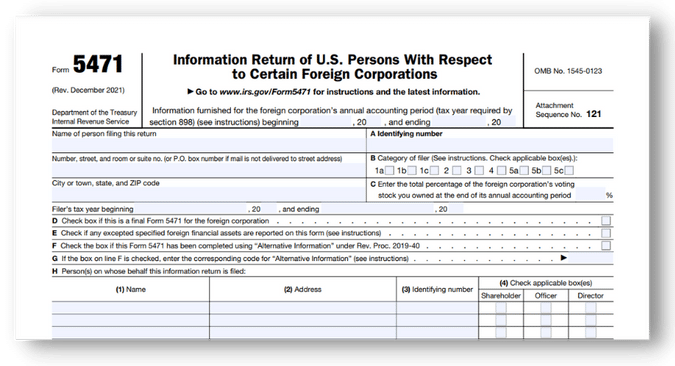

IRS Form 5471: What is it and who must file it?

If you are a US citizen or resident alien and are an officer, director, or shareholder in certain foreign corporations, you must file IRS Form 5471, Information Return of US Persons with Respect to Certain Foreign Corporations, along with your expat taxes.

When filing your expat taxes, it is critical to consult with your Tampa tax accountant to ensure that you file correctly and on time.

Many US expats misread the regulations about who must file Form 5471. To put it simply, the filing requirement applies to every US person (including US residents, partnerships, companies, trusts, and estates) who owns at least 10% of a foreign corporation.

To be more specific, the IRS has identified four main categories of US persons who must file Form 5471 along with their yearly US expat taxes:

Category 1 Filer:

A Category 1 filer is a U.S. shareholder of an SFC who owned that stock on the last day of the SFC’s taxable year at any time through the SFC’s taxable year. An SFC is any foreign corporation in which one or more domestic corporations are shareholders in the United States.

Category 2 Filer:

A Category 2 Filer is a US citizen who is an officer or director of a foreign corporation and holds 10% or more of the foreign corporation’s stock.

Category 3 Filer:

If a US person does any of the following during the year, they meet the qualifications of a Category 3 Filer with respect to a foreign corporation:

- Acquires shares in a foreign corporation, which, when added to any stock acquired on the date of acquisition, fulfills the 10% stock ownership criterion.

- Acquires more stock that meets the 10% stock ownership requirement.

- Becomes a U.S. person while meeting the 10% stock ownership requirement.

- Sells enough shares in the foreign corporation to reduce his or her ownership position to less than 10%.

- Satisfies the requirements for 10% stock ownership in the corporation at the time the corporation is reorganized.

Category 4 Filer:

A US person is a category 4 filer if he possessed control of a foreign corporation during the foreign corporation’s fiscal year. Persons with control are defined by the IRS as anyone who holds more than 50% of the entire combined voting power of all classes of stock entitled to vote, or more than 50% of the total value of shares of all stock of the foreign corporation.

Category 5 Filer:

A category 5 filer is either a US shareholder of a CFC at any point throughout the CFC’s taxable year or owns stock in the foreign corporation on the last day of the fiscal year in which the corporation is a CFC. A CFC is a foreign corporation with U.S. shareholders who own more than 50% of the total combined voting power of all classes of voting stock or the entire value of the corporation’s stock on any day during the tax year of the foreign corporation.

Contact your Tampa Tax Accountant, SDG Accountants Ltd., now for more information on who needs to file Form 5471 and if you fulfill the requirements. We can answer any queries you have concerning US Expat Taxes in Tampa.

US Expat Tax Filing Deadline:

If you fall into one of the five categories listed above, you must file Form 5471 together with your US expat taxes. Due to a two-month delay granted to residents living abroad, the deadline for the US Expatriate tax is June 15th, rather than Tax Day (April 18th). If you are unable to fulfill the above deadline, the IRS will grant you an extension until October 16th. Those who fail to fulfill the deadlines face penalties and interest from the IRS.

Expat business owners may find expat tax filing and the obligations associated with it challenging to understand and comply with. It is critical to speak with an experienced US expat tax accountant to ensure that no mistakes are made during your filing. To get started, call SDG Accountants now or schedule a free introductory consultation. We are delighted to serve as your new Tampa tax accountants.