The world has altered dramatically in the last year and a half. Many small businesses and individuals suffered financially and emotionally as a result of the virus. Staying away from family, not being allowed to meet relatives, being locked up in a house where your mental health is constantly jeopardized, and not being able to eat at your favorite neighborhood pizza place. Everything seemed to be going wrong. Small enterprises failed because they lacked the resources to stay afloat when the world was collapsing around them. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was one of many attempts by the U.S. government to assist these individuals and small businesses financially. However, now that tax season is here, those Americans must determine whether their plan was taxable. We’ll go over some of the major US government programs and see if they’re taxable or not.

We’ll go over the four CARES Act relief programs: Paycheck Protection Program, Economic Injury Disaster Loans, Employee Retention Credit, and Payroll Tax Postponement in order to assess your taxes. Depending on your type of business and situation, these scenarios may vary. Contact your Miami Tax Accountant, SDG Accountants, if you have a question concerning your business that isn’t answered in this article.

Is CARES Act Aid Taxable?

Many taxpayers have wondered whether or not the CARES Act they received is taxable. It is dependent on the program. Here’s a rundown of several of the CARES Act’s programs, along with whether or not they’re taxable.

Paycheck Protection Plan (PPP):

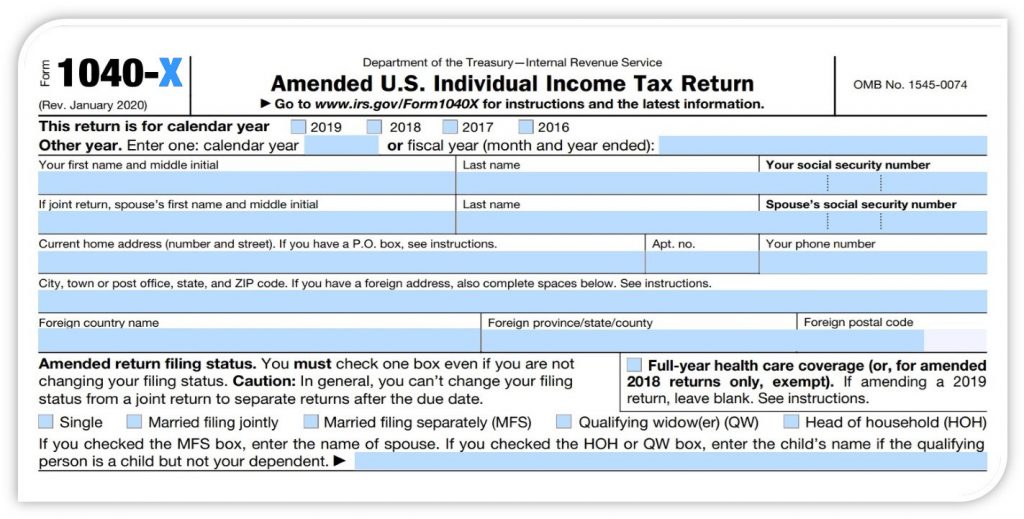

The Paycheck Protection Plan (PPP) is a small business loan program established by the United States government in 2020 as part of the Coronavirus Aid Relief Economic Security Act (CARES Act) to assist small businesses, self-employed workers, sole proprietorships, and other businesses in paying their employees. Owners of small businesses might borrow up to $10 million, or 2.5 times their average monthly payroll. If you followed all of the loan’s terms, the PPP might be considered a grant, and your loan could be forgiven. Your PPP will not be taxable income if this happens. If your loan is not forgiven, it will be treated as a regular loan and will not be taxed. This is only for tax purposes at the federal level.

It differs based on whatever state you live in when it comes to state taxes. For example, forgiven PPP loans are taxed in Florida; they are either included in taxable income or are not allowed as an expense deduction.

Economic Injury Disaster Loans (EIDL):

Another option under the CARES Act is the Economic Injury Disaster Loans (EIDL), which is an enlargement of a long-running BA loan program that assists persons who are financially impacted by the coronavirus. During the spring and summer of 2020, small businesses could apply for a loan of up to $2 million utilizing an EIDL. If a business owner did not want to pay back the loan, they could take out an EIDL advance, which was a cash advance of up to $10,000 that did not require repayment.

The EIDL is included in income and therefore is not taxable, however, if you paid business expenses using EIDL advance those might be deductible.

Employee Retention Credit (ERC):

The Employment Retention Credit (ERC) is a payroll tax credit for business owners to help keep employees on the job. It is not a loan or a grant. This tax credit is claimed on the tax return of business owners (Form 941), therefore it will not be recorded on their income taxes. The following are the downsides of this credit: it can limit the amount you can deduct on your federal income tax return. Qualified wages are likewise not allowed to be counted as income under the ERC.

Payroll Tax Postponement (PTP):

Another program that allowed firms to defer some payments of railroad retirement taxes and Social Security is the Payroll Tax Postponement (PTP). Like the ERC, these delayed payroll taxes were claimed on the employment tax return rather than the income tax form.

What to Do Next?

The U.S. government is constantly changing these programs, and it is your obligation to keep up with all of the changes. It’s difficult to grow your business while still staying on top of all the tax benefits and credits as a small business owner. Make an appointment with a tax specialist who can help you figure out your taxes and the best CARES Act program for you.