IRS will begin accepting 2025 tax returns on January 26, 2026

The Internal Revenue Service (IRS) officially begins the 2026 tax filing season on Monday, January 26, 2026, for individual income tax returns covering the 2025 tax year.

For the 2025 tax year (returns filed in early 2026), several key inflation adjustments and legislative changes affect your return. Here are the essential figures and updates you need to know before you file.

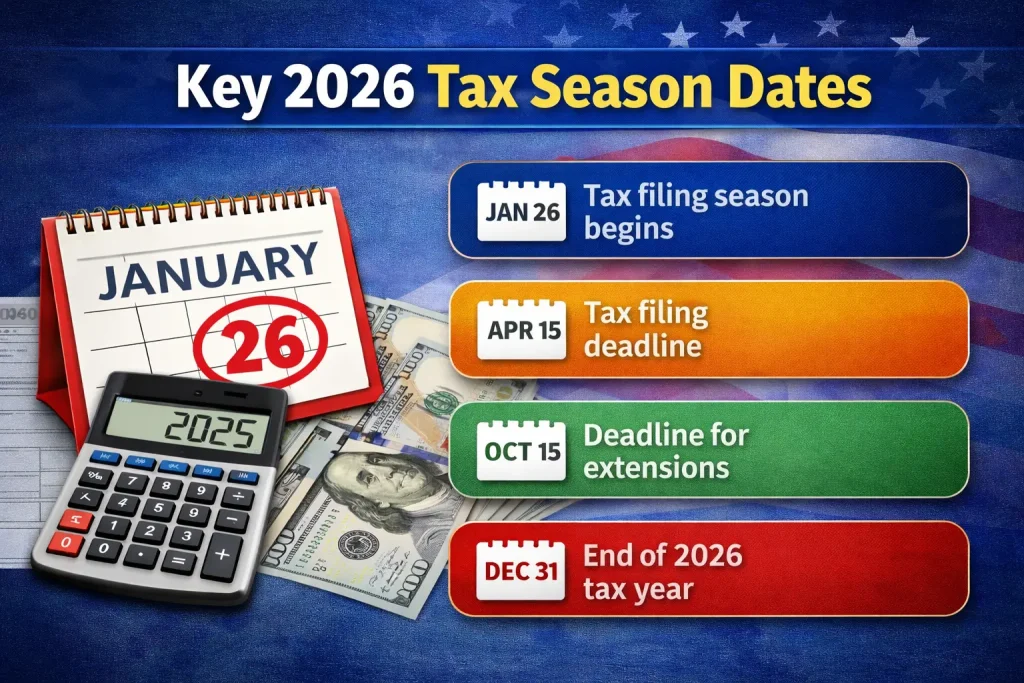

Key 2026 Tax Season Dates

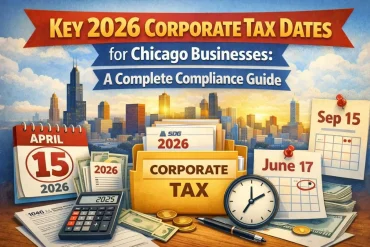

If you are self-employed, a freelancer, or have significant income not subject to withholding (like dividends or rent), these are your payment deadlines for the 2026 tax year.

- January 9, 2026: IRS Free File opens for “qualified taxpayers” with an Adjusted Gross Income (AGI) of $89,000 or less. While returns can be submitted through Free File partners on this date, the IRS may not begin processing them until the official start of the season.

- January 26, 2026: Official start date for accepting and processing all individual 2025 federal tax returns.

- April 15, 2026: The standard deadline to file 2025 federal income tax returns or request an automatic six-month extension.

- October 15, 2026: Final deadline for those who requested a filing extension.

Important Filing Information

1. Refund Timing

Most taxpayers filing electronically with direct deposit can expect a refund within 21 days. However, by law, the IRS cannot issue refunds involving the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) before mid-February.

2. Preparation Tools

You can use your IRS Online Account to view your balance, payment history, and key tax records before filing.

3. New Tax Law

Returns for the 2025 tax year are the first to incorporate provisions from the “One Big Beautiful Bill Act,” which may impact certain credits and deductions.

How SDG Accountants Can Help?

With the IRS officially opening the filing season on January 26, 2026, SDG Accountants & Enrolled Agents are uniquely positioned to ensure clients navigate the 2025 tax year successfully.

- Navigating New Legislation: As Enrolled Agents, our professional team can expertly interpret the complexities of the new “One Big Beautiful Bill Act,” ensuring clients maximize their benefits under the newly impacted credits and deductions.

- Early & Accurate Filing: By preparing documentation prior to the January 26 opening, SDG Accountants can ensure clients’ returns are submitted immediately upon the opening of IRS systems, expediting the 21-day refund window for eligible filers.

- Managing Refund Expectations: SDG Accountants & Enrolled Agents can proactively advise clients claiming the EITC or ACTC about the mandatory mid-February hold and set realistic expectations for the timing of their funds.

- Extension Management: For clients unable to meet the April 15 deadline, our Cross-Border Accountants can secure the necessary six-month extension to avoid penalties.

Whether you’re filing as an individual, self-employed professional, or small business owner, our Chicago Accountant ensures your tax process is smooth and stress-free.

Final Thought

SDG Accountants & Enrolled Agents can assist you in determining the best potential solution to your tax concerns. Contact us immediately to schedule a consultation and take advantage of the best available rates.