If you’re a business owner, you may be considering filing an S Corp Election for your business. An S Corp is a type of corporation that provides many tax benefits, including pass-through taxation and limited liability for shareholders. In this post, we’ll walk you through the steps of filing an S Corp election and explain how our tax experts in Miami and Tampa can help you make the process simple and stress-free.

Step 1: Ensure Your Business Is Eligible for S Corp Status

Before filing an S Corp election, you need to ensure that your business is eligible for S Corp status. To qualify, your business must be a domestic corporation and meet several other requirements, including having no more than 100 shareholders and only one class of stock.

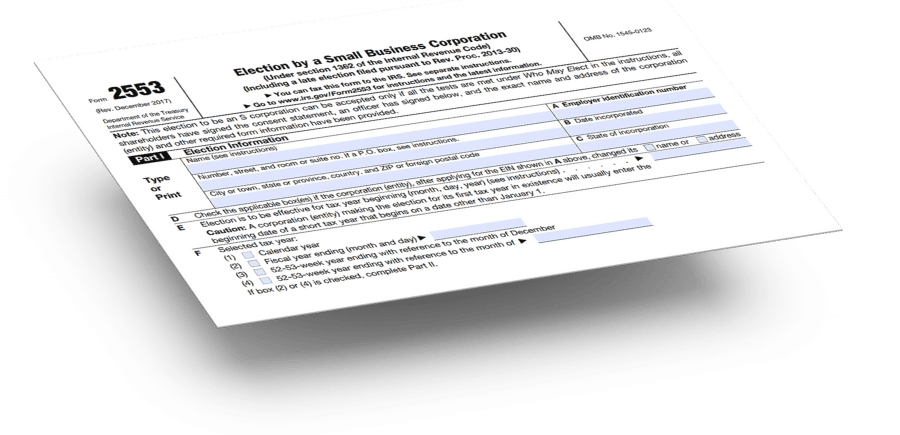

Step 2: Prepare and File Form 2553

To file an S Corp election, you need to prepare and file IRS Form 2553 with the IRS. The form must be signed by all corporation shareholders and filed within 75 days of the beginning of the tax year for which you want to be treated as an S Corp.

Filing Form 2553 can be a complex process, and there are several essential details that need to be considered. That’s why it’s important to work with a tax expert who has experience in filing S Corp elections. At SDG Accountants, our team of tax experts in Miami and Tampa can help you prepare and file IRS form 2553 correctly, ensuring that you are taking advantage of all the tax benefits of S Corp status.

Step 3: Keep Records and File Annual Tax Returns

Once you have filed an S Corp election, keeping records and filing annual tax returns is important. As an S Corp, you will need to file an annual tax return on Form 1120S. This form reports the income, deductions, and credits of the S Corp and is used to calculate the tax liability of the corporation.

Free up your time to focus on what matters.

Growing your business.

Our tax experts in Miami and Tampa can help you with your annual tax returns and provide guidance on the record-keeping requirements for S Corps. We can also help you take advantage of other tax benefits that come with S Corp status, such as the ability to deduct certain expenses.

In Conclusion

Filing an S Corp election can provide many tax benefits for your business. However, the process can be complex, and it’s important to work with a tax expert who has experience in filing S Corp elections. Our team of tax experts in Miami and Tampa can help you make the process simple and stress-free, allowing you to focus on running your business. Contact us today to learn more about how we can help you file an S Corp election and take advantage of all the tax benefits that come with S Corp status.