What is a 401(k) Plan?

A 401(k) plan is a type of retirement savings account that is primarily offered by employers to their workers. The 401(k) plan is tax-advantaged, meaning it is tax-free. The 401(k) plan gets its name from a section of the Internal Revenue Code in the United States. Automatic payroll withholding to their 401(k) account could be used to make contributions to the plan. The contributions might then be matched by the employers for their employees. Withdrawals and the IRA plan are chosen for the 401(k) plans both affect taxes. Investment earnings will not be taxed until the employee withdraws the money if a traditional 410(k) was used. Employees will be taxed when contributions are made to a Roth 401(k).

How Do 401(k) Plans Work?

Traditional 401(k)s and Roth 401(k)s, also known as “designated Roth accounts,” are the two most common types of 401(k) accounts. Traditional and Roth 401(k)s are similar in many ways, but there are some differences in terms of withdrawals and taxes. Let’s take a closer look at it now.

Contributing to a 401(k) Plan:

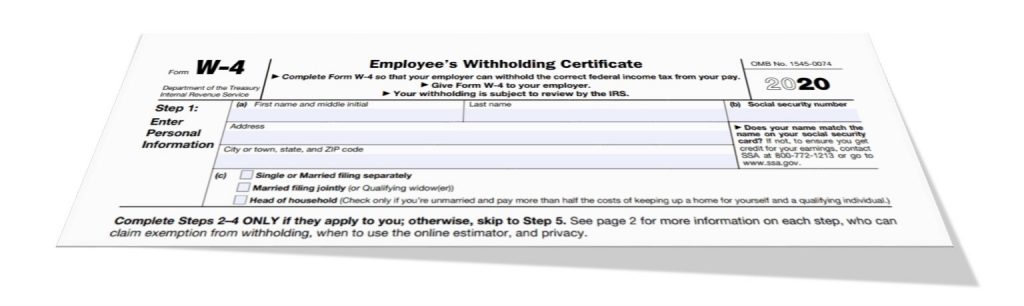

A defined contribution plan is a tax-deferred retirement savings account that accumulates tax-free until the investor takes withdrawals. 401(k) and 403(b) plans are examples of defined contribution plans. Contributions to the account are subject to dollar limits set by the Internal Revenue Service (IRS). Both the employee and the employer can contribute until the dollar cap is reached. A traditional pension plan, on the other hand, is not the same as a traditional 401(k). Traditional pensions are a defined benefit plan, which means the business is responsible for paying the employee a set amount of money when they retire. Many firms choose to offer their employees a 401(k) plan because it is more efficient and eliminates the stress of having to save for retirement for their employees.

Employees are given a variety of specific investments to choose from in their 401(k) plans, and they are responsible for picking from the options provided by their employer. Typically, the employer’s choices include mutual funds for stocks and bonds, as well as funds that are a mix of stocks and bonds. A Guaranteed Investment Contract (GIC) is an insurance company policy that promises a rate of return in exchange for retaining a deposit for a specified amount of time.

What are my Contribution Limits?

The contribution limit, or the maximum amount that an employer or employee can contribute, is changed to account for inflation on a regular basis. The following are the basic contribution limitations for 2020 and 2021. The annual contribution maximum for employees under the age of 50 is $19,500. The annual contribution maximum for workers over the age of 50 is $26,500.

If the company wishes to contribute as well, or if the employee wants to make additional non-deductible after-tax payments to their traditional 401(k), the numbers above will vary. This is only possible if the employer’s plan permits it. As of 2021, the ceiling for workers under the age of 50 would be $58,000, or 100 percent of employee compensation. As of 2021, the maximum for workers over the age of 50 will be $64,500.

Employer Matching:

Employee contributions to their 401(k) accounts are sometimes matched by their employers. Employers calculate the match using various formulas. Employers frequently use the $1 for every dollar an employee contributes up to a particular proportion of their salary formula. Employees should contribute enough to their 401(k) plans to receive the full employer match, according to most financial consultants.

Contributing to Both a Traditional and Roth 401(k):

If the employer wishes, some firms allow employees to contribute to both traditional and Roth 401(k)s at the same time. Contributions could be divided into two categories: regular 401(k) and Roth 401(k). Keep in mind, however, that the total contributions to both accounts, depending on the employee’s age, cannot exceed the maximum.

Making Withdrawals from a 401(k) Plan:

Employees who deposit money into a 401(k) account are unable to withdraw it without incurring a penalty. Employees should set aside a specific amount of money outside of their 401(k) plan for emergencies. This money is inaccessible, and it would be pointless to deposit all your savings into a 401(k) account if you couldn’t access it.

Earnings in a traditional 401(k) account are tax-deferred. Earnings in a Roth 401(k) account are tax-free. When you take money out of a traditional 401(k) account, you will have to pay taxes on it. It would be subject to regular income taxation. Withdrawals from a Roth 401(k) plan, on the other hand, are tax-free and will not be taxed because the money was taxed when you originally contributed it.

How Can SDG Accountants Help?

It may be difficult to comprehend all these retirement and contribution options. Particularly when these plans are incorporated into your federal, state, and local income taxes. We operate to help you include your 401(k) plan in your federal income tax. Contact your Miami Tax Accountant today to find out which plan is ideal for you and to discuss all your other tax requirements.