The Social Security Administration has announced the Social Security indexed amounts for 2023. The gross Social Security benefit amounts are increasing by 8.7% for 2023. Some of the other limits change by different percentages. Here is the information for 2023 (followed by 2022 amounts):

The amounts of earnings subject to Social Security taxes increase to $160,200 (up from $147,000 for 2022). This translates into an additional $818.40 of social security tax withholding for those employees at the maximum earnings level. The employer would also match that amount for a total of $1,636.80. And self-employed individuals at the maximum earnings would pay an additional $1,636.80.

The amount of earnings required to be subjected to Social Security taxes in order to receive a quarter of coverage increases to $1,640 (up from $1,510).

Earnings limitations for taxpayers who have not reached full retirement age (before having to repay Social Security benefit amounts) increases to $21,240 ($1,770/month) [up from $19,560 ($1,630/month)].

Earnings limitations for taxpayers who reach full retirement age in the current year (before having to repay Social Security benefits) increases to $56,520 ($4,710/month) [up from $51,960 ($4,330/month)].

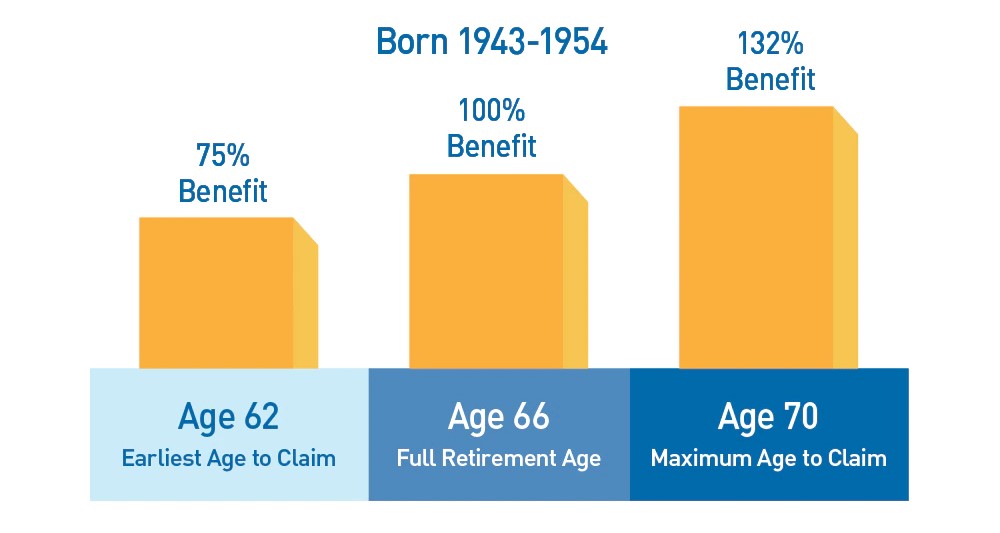

“Full retirement age” depends on the year the taxpayer is born:

- Age 66 for those born in 1943-1954.

- Age 66 years and 2 months for those born in 1955.

- Age 66 years and 4 months for those born in 1956.

- Age 66 years and 6 months for those born in 1957.

- Age 66 years and 8 months for those born in 1958.

- Age 66 years and 10 months for those born in 1959.

- Age 67 years for those born in 1955.

The amount of the SSI Federal Payment Standard increases to $914/month (up from $841/month). For a married couple this increase to $1,371 (up from $1,261/month). The SSI Student Exclusion Limits increase to $2,220/month with an annual limit of $8,950 (up from $2,040/month with an annual limit of $8,230).

The Substantial Gainful Activity Earnings increase to $1,470/month for non-blind disabled recipients (up from $1,350/month) while the blind disabled recipient amount increases to $2,460 (up from $2,260/month). The Trial Work Period earnings increase to $1,050/month (up from $970/month).

The full Social Security Administration Press Release (including a link to the Fact Sheet) can be found by going to ssa.gov, clicking on Press Releases, and opening the Press Release from October 13, 2022, titled “Social Security Announces 8.7 Percent Benefit Increase for 2023.”