Many people have valid reasons for failing to file their taxes by the deadline. Every year, you must file your taxes by Tax Day, which is April 15th (Tax Day is usually on April 15 but was set back in 2020 and 2021 due to COVID-19). Here is how to avoid penalties for failing to file your taxes by the due date.

What is a Tax Extension?

A tax extension is a period of time granted by the IRS to taxpayers who are unable to file their taxes by the deadline. The extension is valid for six months and is available to all taxpayers. Filing an extension allows taxpayers to postpone their tax filing, but it does not exempt them from paying any back taxes.

There is an exception for taxpayers who are unable to return to the country during tax season. This means that if a taxpayer’s primary work is outside of the United States or Puerto Rico, the IRS will grant them an extension. If a taxpayer is “out of the country,” the IRS will automatically grant them a two-month extension without the need to fill out any forms. For someone who is not in the nation when taxes are due, that period lasts until June. If the taxpayer then requests for the standard six-month extension, they will still have until October 15 to file their taxes.

To learn more about whether you are eligible for the two-month extension, contact SDG Accountants and we will provide you with all the information you want at reasonable rates.

When should you get an Extension?

Although you do not need a reason to request an extension from the IRS, it is nevertheless important that you only request one for logical reasons. Here are some of the most common reasons why taxpayers file an extension each year.

Some typical reasons for requesting extensions include being on vacation and not being able to pay or file your taxes until you return. You will also be unable to file your taxes if you do not have all the required tax forms and documents. Because all forms and documentation are required when submitting your taxes, you should request an extension if you are unable to collect them all on time. You are not in a good financial position to be concerned about taxes right now. If you do not file your taxes on time or pay any overdue taxes on time, you will be penalized by the IRS, which is why you should always file an extension if necessary.

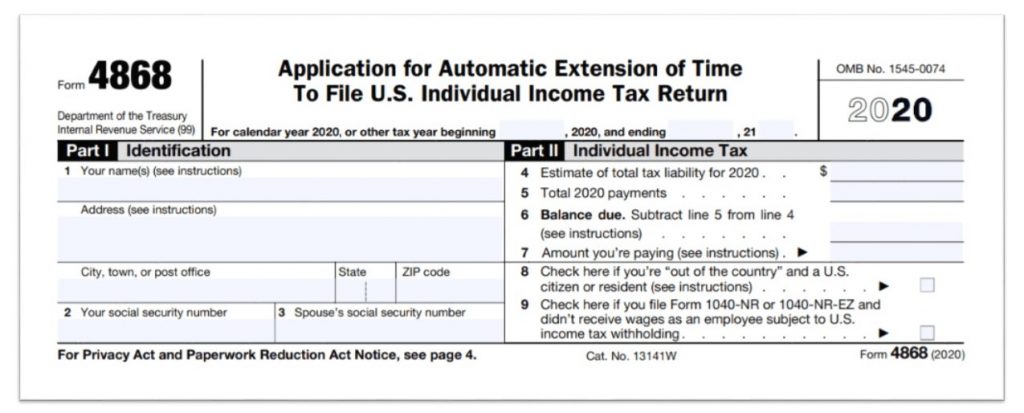

How to File for a Tax Extension?

To request a tax extension, complete Form 4868 by the due date (Tax Day). The form can be completed online or mailed to the IRS. The IRS makes the form available online in PDF format, so anyone can download or print it. If you need to file an extension, schedule a consultation with one of our experienced tax consultants today at a very affordable rate.

Is a State Tax Extension Any Different from a Federal Tax Extension?

A federal tax extension is similar to a state tax extension. If you file for a federal extension, you will almost always be granted a state extension as well. Some states, however, have different rules and deadlines for their taxpayers. In Florida, for example, you must file a state form F-7004 before the due date to receive a 6-month extension. In other states, such as Virginia and Colorado, taxpayers automatically receive a 6-month extension if they do not apply for it. Every state has its own set of laws and deadlines, and all taxpayers should adhere to the deadlines in their current state.

To learn more about how to file for an extension, consult our Miami Tax Accountants today. We can give you the best advice on your tax issues and assist you in filing extensions at reasonable costs.