The Employee Retention Credit (ERC) is a tax credit that has been a valuable tool for businesses in Tampa and Miami during the COVID-19 pandemic. The ERC was introduced in the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) in March 2020. It was designed to help businesses keep their employees on payroll during the pandemic. The credit has since been extended and expanded under subsequent legislation, making it a valuable tool for businesses seeking to retain their employees and navigate the challenges of the pandemic.

The ERC is available to eligible employers that experienced a significant decline in gross receipts or were fully or partially suspended due to government orders related to the COVID-19 pandemic. Eligible employers can claim a tax credit of up to 70% of the qualified wages paid to their employees, up to a maximum of $10,000 per employee per quarter.

Free up your time to focus on what matters.

Growing your business.

For businesses in Tampa and Miami, the ERC can be especially valuable. The pandemic has hit these two cities hard, with many businesses struggling to stay afloat. The ERC can help businesses in these cities to retain their employees and keep their doors open. The credit can provide much-needed relief to businesses that are facing financial challenges due to the pandemic.

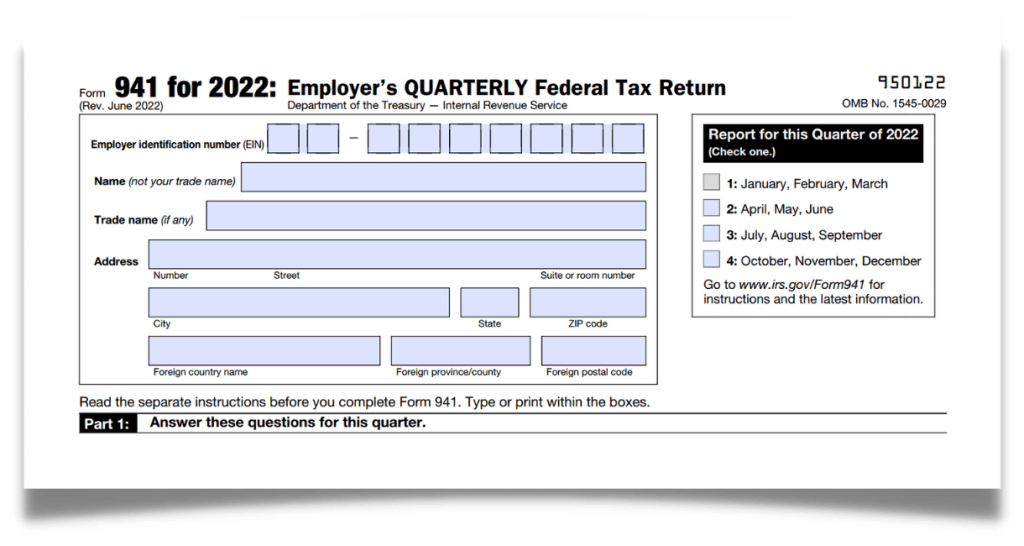

To claim the ERC, eligible employers must file Form 941, Employer’s Quarterly Federal Tax Return, with the IRS. The credit is claimed on Line 11c of the form. Employers can also claim the credit in advance by reducing federal employment tax deposits.

It’s important to note that there are some restrictions and limitations on the ERC. For example, employers that receive a Paycheck Protection Program (PPP) loan may not be eligible for the ERC for the same wages. However, businesses that have already received a PPP loan can still claim the ERC for wages that are not covered by the loan.

In Conclusion

The Employee Retention Credit is a valuable tool for businesses in Tampa and Miami that are struggling during the COVID-19 pandemic. Credit can help businesses to retain their employees and keep their doors open during this challenging time. If you are a business owner in Tampa or Miami, it’s worth exploring whether you are eligible for the ERC and how you can claim the credit. By taking advantage of this tax credit, you can help your business to weather the storm and emerge stronger on the other side.