Although most taxpayers pay a fixed rate, some are paying a parallel tax rate. This may apply to everyone for various reasons. Exemptions and varied tax rates are included in Alternative Minimum Tax (AMT). Read below to find out more.

What is Alternative Minimum Tax (AMT)?

An AMT is another method to calculate income tax for individuals. AMT is a different way. To calculate your tax, if your income reaches a specific level, the IRS uses a parallel tax system. You have two ways of calculating your taxes if you are subject to the AMT. The taxpayer has to pay a higher fee when the AMT results in a larger tax bill. The AMT has several restrictions on the income and deductions that it employs.

For taxpayers earning above specific limits, the IRS has established an alternative minimum tax. The basic goal of the AMT is to recalculate income tax so that adjusted gross income includes certain tax benefits. After allowing deductions, the AMT applies a new set of criteria for calculating the tax, and primary deductions are then re-added to the income for calculating a minimum taxable alternative income. The final amount is then calculated by the exemption from AMT.

The primary goal of the AMT is for all taxpayers to have a fair tax rate to pay the minimum tax. This is a method for avoiding the use of deductions for wealthy taxpayers. The AMT guarantees that all taxpayers, rich or poor, pay the same minimum level of taxation.

Calculating AMT

The AMT uses the taxpayer’s regular tax income to adjust it by making use of its preferences. Alternatively, the calculations add additional income to the usual taxable income or deductions to provide for the alternative minimum taxable income (AMTI). Following adjustments, the exemption for AMT is subtracted and the implementation of the AMT tax rates determines the tentative minimum tax.

You can determine if you are subjected to the AMT in various ways. If you claim certain itemized deductions on your Schedule A, exercise Intensive Stock Options (ISOs), but don’t sell your stock in the same year, and have interest received through private activity bonds, you may be subjected to the AMT.

AMT Exemptions

The AMT exemption is applied after the alternative minimum taxable income, or AMTI is determined by removing or adding adjustment and preference items. The amount of the exemption is determined by your AMTI and your tax-filing status for the year. For the tax year 2020, if you are married and filing jointly or a qualifying widower, your exemption amount is $113,400. If you’re a single or head of household taxpayer, the figure is changed to $72,900, and if you’re married filing separately, it’s now $56,700.

It’s important to note that an AMTI exemption for taxpayers having AMTI beyond a specific threshold isn’t available. For taxpayers married filing jointly or qualified widowers, the amounts free for 2020 are gradually lowered to a rate of 25 cents for every $1 of AMT income exceeding $1,036,800. For single taxpayers or head-of-household taxpayers, the phase-out begins at $518,400. The phase-out begins at $518,400 for married taxpayers filing separately.

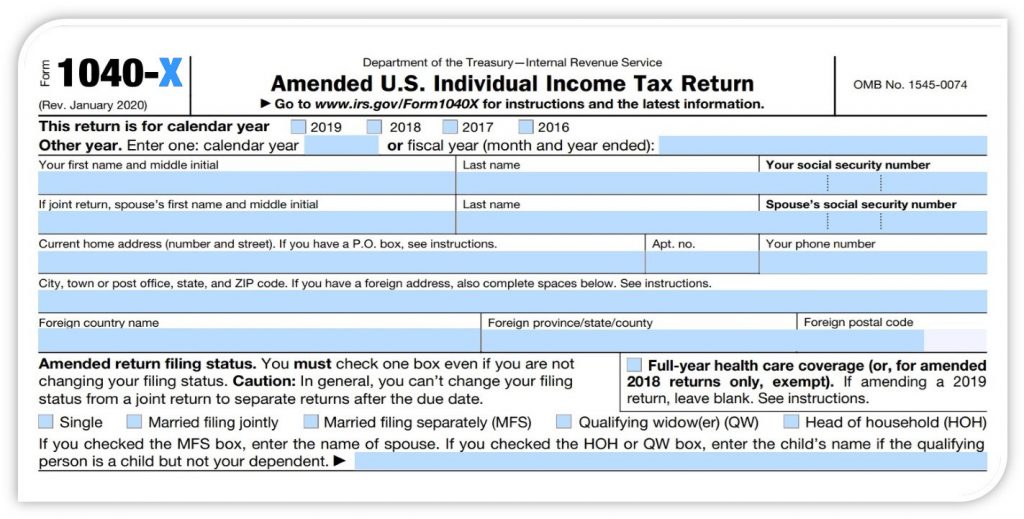

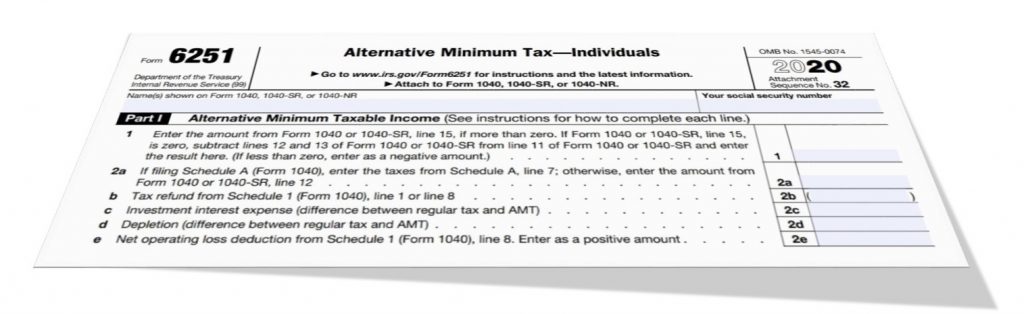

These exemption amounts will be deducted from your AMTI depending on your filing status, and the remaining income will be subject to the AMT rate. Individuals can use a tax software program or fill out IRS Form 6251 to see if they owe AMT. Medical expenditures, home mortgage interest, and other deductions are all requested on the form. Other information, such as tax refunds, capital gains, and so on, is also requested on the form. Contact a Miami Tax Accountant or a Tax Preparer in Miami for a thorough estimate of your AMT and to see if you qualify.

Some taxpayers may wish to avoid the AMT, and this is doable. You must understand how the AMT works and how it differs from the ordinary tax system if you wish to avoid the AMT. Many deductions and expenses that count towards AMT are listed on IRS Form 6251. Taxable income, standard deductions, deductible expenses, tax refunds, investment interest, depletion, and net operating loss are some of the lines on the form. It also inquires about stock income incentives and stock options. You may lose tax benefits such as low-income housing or work opportunity credits because of the AMT.