If you run a corporation in Chicago, staying ahead of tax deadlines is critical. Missed filings can lead to penalties, interest, and even IRS scrutiny. This guide outlines the 2026 federal and Illinois deadlines for C-Corps and S-Corps and provides actionable tips for smooth compliance.

💰 Why Chicago Businesses Must Track Corporate Tax Deadlines

C-Corporations and S-Corporations face federal and state deadlines that must be met to avoid unnecessary fees. Cook County businesses also have additional local obligations to consider, including licenses and property filings.

🏛 Federal Filing Requirements for 2026

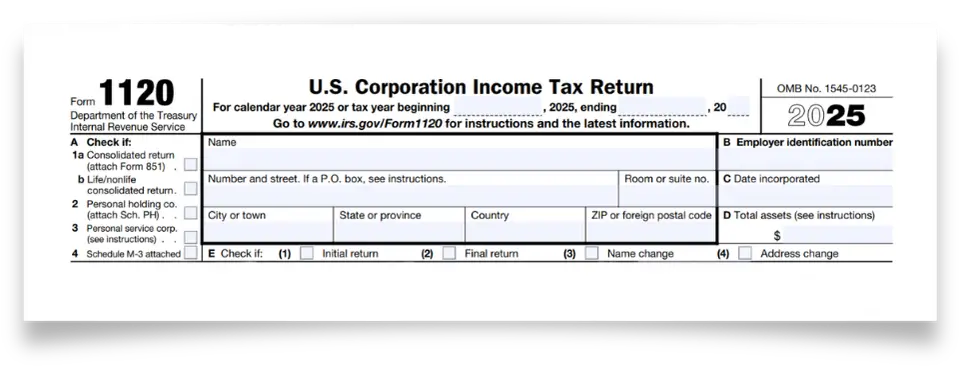

1. C-Corporations (Form 1120)

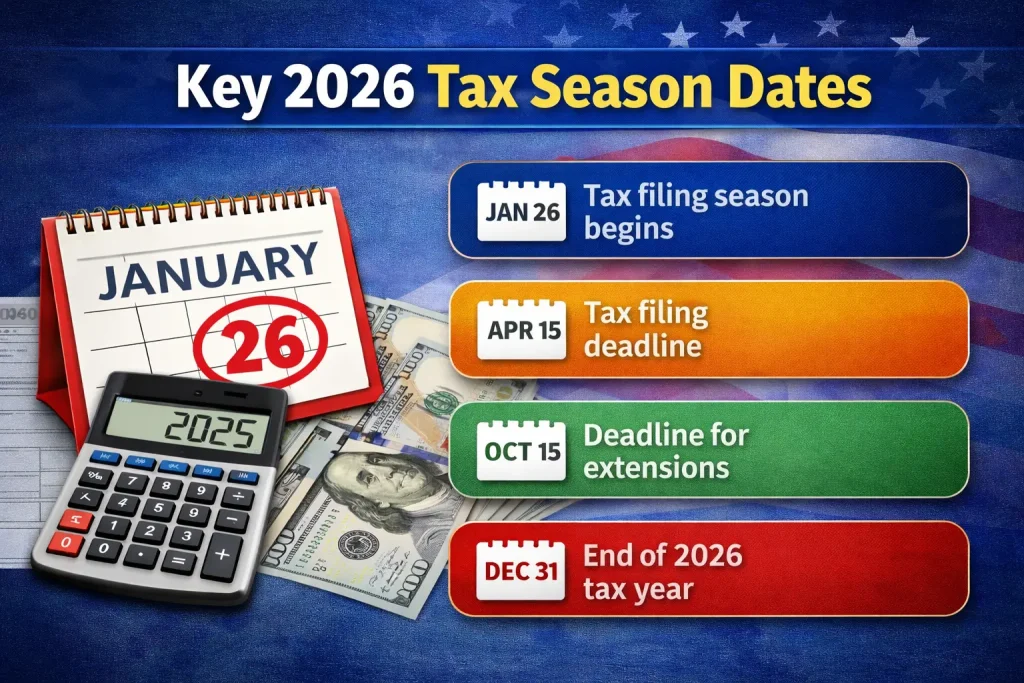

- 👉 Deadline: April 15, 2026

- 👉 Extension: October 15, 2026 (Form 7004)

- 👉 Quarterly Estimated Tax: April 15, June 15, September 15, December 15

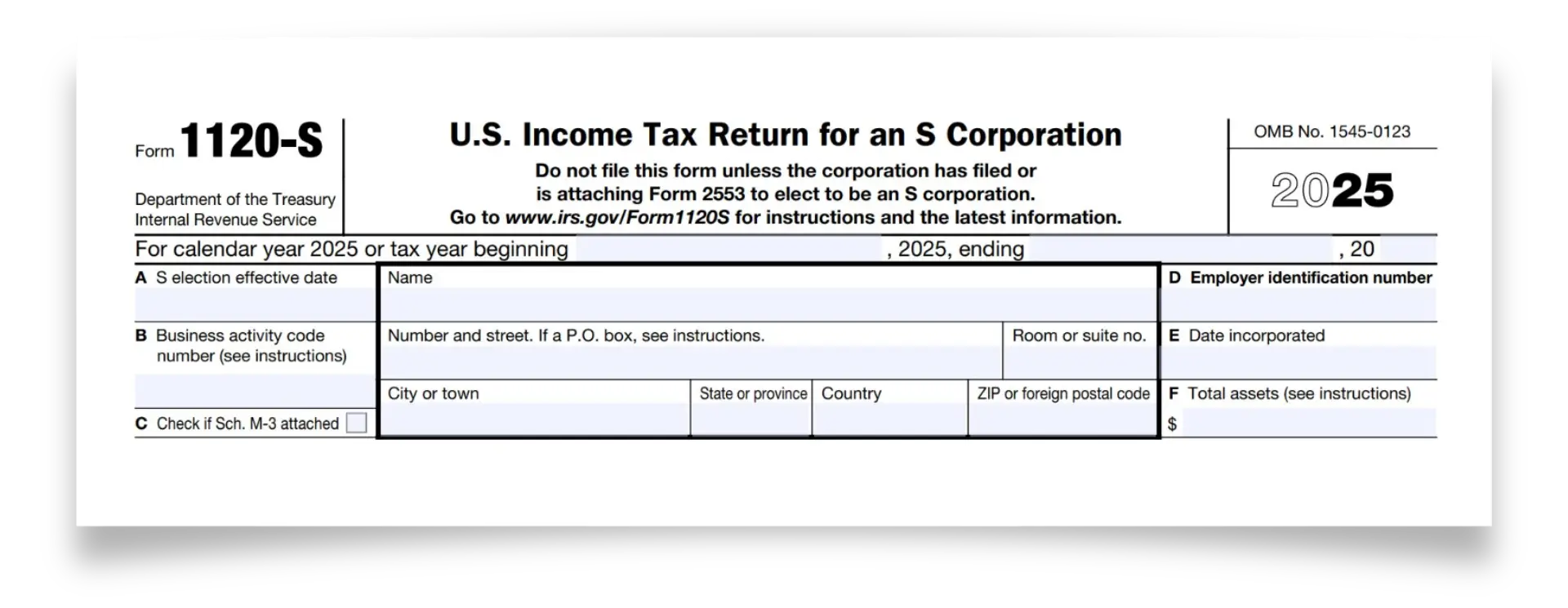

1. C-Corporations (Form 1120-S)

- 👉 Deadline: March 16, 2026

- 👉 Extension: September 15, 2026

Note: Extensions provide more time to file, not more time to pay taxes owed.

📋 Federal Filing Requirements for 2026

- 👉 Form IL-1120 (C-Corp) / IL-1120-ST (S-Corp)

- 👉 Illinois corporate income tax: 7% plus 2.5% replacement tax

- 👉 Deadlines generally mirror federal filing dates

- 👉 Ensure state estimated tax payments are made when applicable

📍 Cook County & Chicago Local Considerations

- 👉 Local business licenses may need annual renewal

- 👉 Personal Property Lease Transaction or Amusement Taxes may apply depending on business type

- 👉 Align local filings with federal deadlines to prevent fines

🕐 Quick 2026 Deadline Reference

| Filing Requirement | Deadline |

|---|---|

| Federal Return (C-Corp) | April 15, 2026 |

| Federal Return (S-Corp) | March 16, 2026 |

| Illinois Return | Same as federal |

| Q1 Estimated Tax | April 15, 2026 |

🚫 Avoiding Common Chicago Corporate Tax Mistakes

- 👉 Missing the S-Corp March 16 deadline

- 👉 Forgetting state estimated payments

- 👉 Filing an extension without paying taxes owed

- 👉 Not updating the registered agent or company info

Need help staying compliant with 2026 corporate tax deadlines in Chicago?

📩 How We Support Chicago Corporations

- 👉 Full federal & Illinois filing services

- 👉 Deadline tracking & compliance calendar

- 👉 Estimated tax calculation

- 👉 Audit support & strategic planning

Reach out to SDG Accountant & Enrolled Agents, and our Chicago Accountants will be more than happy to assist you. For tailored guidance on your unique tax circumstances, don’t hesitate to click below for a consultation with one of our skilled Chicago tax accountants. Schedule a consultation today to avoid penalties and simplify your tax workflow.