Many people in the United States wonder if they have to pay taxes on inheritances. Let us begin by defining what inheritance is. An inheritance is a gift from a deceased person; a relative, or a friend. If you have received an inheritance, you may now be subject to three types of taxes. Inheritance tax, capital gains tax, and the estate tax would be the three taxes.

Inheritance Tax: An inheritance tax is a tax levied on a decedent’s property.

Capital Gains Tax: After the property you inherited has been sold, you must pay a capital gains tax. The tax would be levied on the selling earnings rather than the property itself.

A tax on the value of the inherited property is known as an estate tax. The estate, not the heirs, would be responsible for this tax. It may potentially lower the inheritance’s worth.

Inheritance Taxes at the Federal Level:

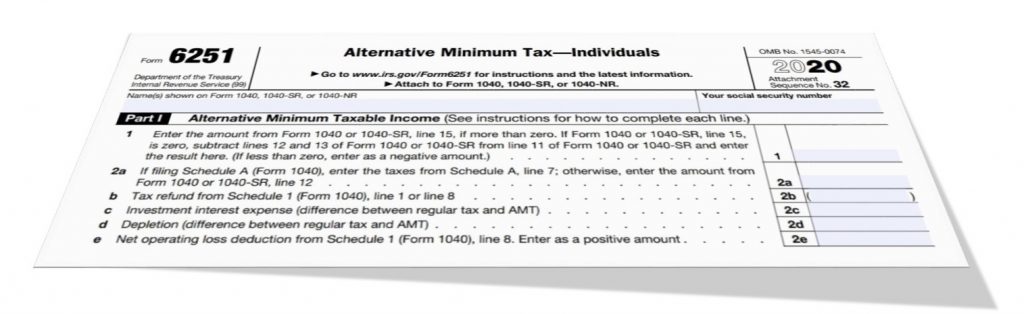

The Internal Revenue Service (IRS) is more concerned with capital gains tax than with all other sorts of inheritance taxes. Inheritances aren’t often subject to income taxes, and the federal government doesn’t levy one either. In many circumstances, inheritances are made in cash, such as your cousin leaving you $30,000 in cash, which is tax-free because it is not considered income.

Inheritance Taxes at the State Level:

Only 6 of the 50 states in the United States collect inheritance taxes; if you don’t live in one of these states, you won’t have to worry about inheritance taxes. Iowa, Kentucky, Maryland, Nebraska, and New Jersey are the six states that collect inheritance taxes. Even if you live in one of the six states, you can consider yourself tax-free as long as the decedent lived in one of the other 44 states. It’s also possible that property was left to an alive spouse, which would be exempt from inheritance taxes in all 50 states of the United States. Only Nebraska and Pennsylvania would levy an inheritance tax if the property was left to the decedent’s children or grandchildren.

Income Taxes for Inheritance at the State and Federal Level:

As previously stated, inheritance property is not considered taxable income and hence is not subject to income taxation. Depending on the sort of property you inherited, you may be required to pay some built-in income taxes.

Capital Gains Tax:

Capital gain is the difference between the asset’s worth and the amount you sell it back for. Because the capital gain is taxable income, you will have to pay capital gains tax to the IRS when you sell the inheritance property. If, on the other hand, the inheritance was sold for less than its worth, it will be regarded as a capital loss, and so no capital gains tax will be due.

For inheritance properties, the IRS imposes a different tax bracket than for regular income. This benefits taxpayers who are subject to capital gains tax as a result of the sale of their inherited property. Keep in mind that capital gains are calculated using the asset’s value on the day of the decedent’s death, not the asset’s worth when it was first purchased. This is beneficial to the taxpayer because they will have to pay fewer taxes.

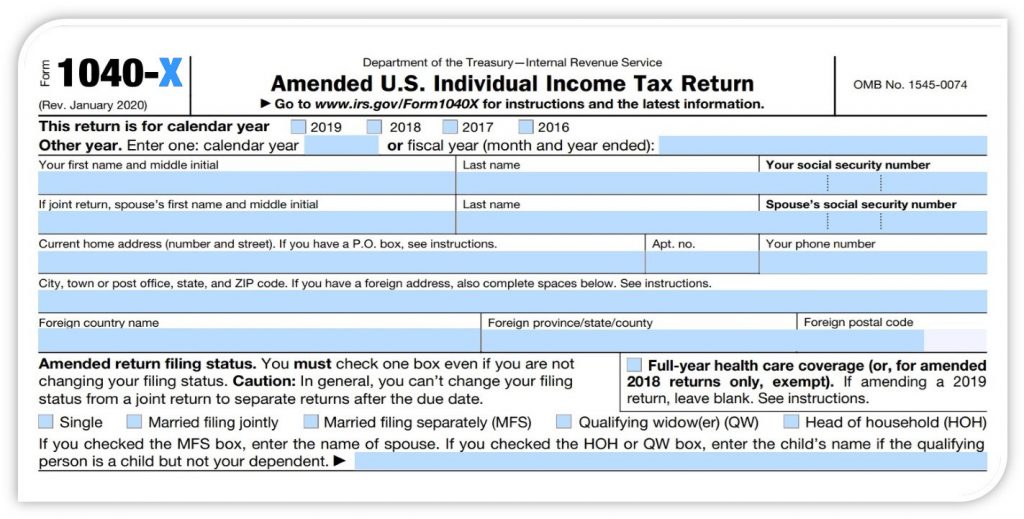

State and Federal Level Estate Taxes:

Your inheritance property may be subject to state and federal estate taxes. The federal estate tax exemption is $11.4 million as of 2019. If an estate’s worth is less than this, there will be no estate tax. As of 2021, the District of Columbia and 12 other states also impose a state-level estate tax. Connecticut, Maine, Maryland, Hawaii, Washington, Rhode Island, Massachusetts, New York, Oregon, Minnesota, Vermont, and Illinois are the twelve states. If the inherited property is located in one of these states, you will be subject to state estate taxes.

If you do not live in one of those 12 states or the District of Columbia, the state’s estate tax will only apply if the exemption amount is surpassed. On the other hand, state-level exemptions are substantially lower than federal exemptions, with some states offering exemptions as low as $1 million.

Keep in mind that state-level estate taxes will be due and paid before you receive your inheritance.

Contact your Downtown Miami Tax Accountant for help with your inheritance taxes. Book a consultation using the in below or contact SDG Accountants by phone: +1 (786) 706-5905 or by email: admin@sdgaccountant.com.