Almost everything in America is subject to taxation. It’s as though you can never get away from the government. If you don’t pay your taxes, they’ll come after you like hunters, seeking to acquire the money they need to cover the country’s expenses. Everything is taxed, from fast food to living in a neighborhood. You’re effectively running the government since the country can’t function if you don’t pay your taxes. You will be required to pay taxes if your neighborhood requires road maintenance. Overall, you and your neighbors are responsible for maintaining the neighborhood clean and well-kept. Personal property tax is one of the many taxes you must pay, and that is what we will be discussing today in this article.

What is Personal Property Tax?

A personal property tax is a levy imposed by state or municipal governments on certain types of properties held by residents. Personal property refers to assets that are not considered real property, such as land or houses. Personal property taxes are typically collected by the local government or the state for purposes such as funding public works projects. This might involve things like road construction and school construction. Property tax is not required in every state, and the states that do levy it have varied rates. It’s critical to understand the distinction between personal and real property. Personal property is moveable and cannot be permanently placed in one area. Some personal property taxes are calculated as a percentage of the total value of the item. Cars, furniture, boats, and other valued items are examples of personal property taxes.

What are Some Examples of Personal Property?

Every state has its own set of rules for determining whether assets are taxable. Many states that levy a personal property tax take into account goods like machinery, equipment, and furniture that are utilized for business, sold, or stored. The following are examples of possible items:

- Aircraft

- Automobiles

- Mobile homes

- Office equipment and furnishings

- Boats

- Trailers

- Farm machinery and equipment

- Supplies other than inventory supplies

- Books, media, CDs, and other equipment all available at libraries. Including the library itself.

What Items are Not Subject to Personal Property Tax?

As previously stated, each state has its own set of rules, and the types of personal property that are taxable differ. The following are some of the most common goods that aren’t taxed as personal property:

- Intangible personal property: intangible personal property includes shares of stock, bones, money at interest, patents, trademarks, company records, notes, computer software, designs, and surveys, which are not subject to personal property tax.

- Personal property tax does not apply to farm animals.

- Personal property tax will not apply to household goods, clothing, or equipment used for personal purposes around the house.

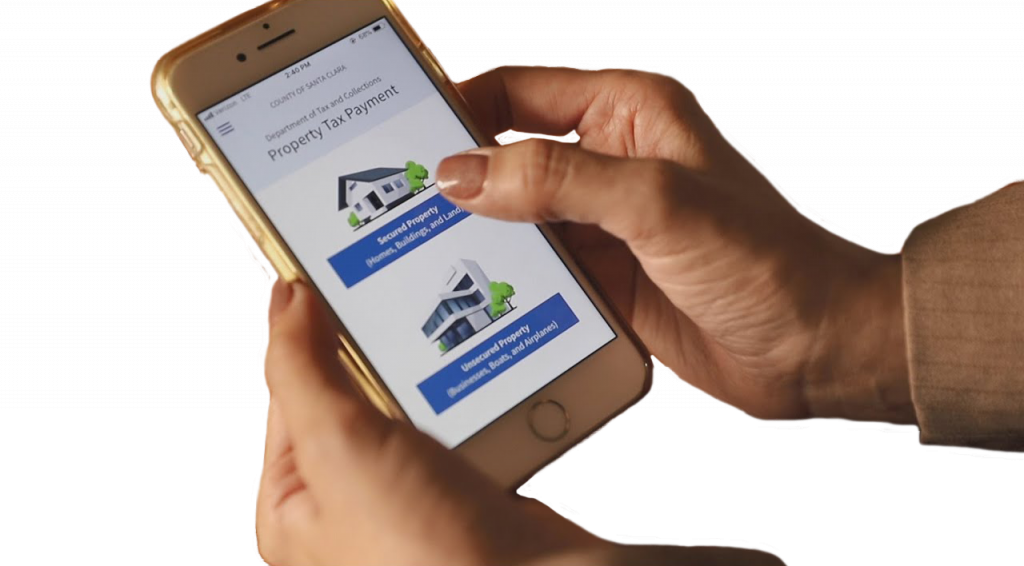

How to File and Pay Personal Property Tax?

Personal property taxes are usually due and assessed on January 1 in states that have them. After being assessed, the final tax bill is mailed to the individuals or businesses who owe taxes. When you buy certain types of properties, such as those described above, it is recommended that you register them with your local tax office, either online or in-person, using a form. It is up to you to decide whether or not to fill out this form based on where you live. There may be a yearly deadline for submitting this form.

To learn more about whether your recent property purchase is subject to property tax, call your best tax preparer in Miami.

Failing to Pay Personal Property Tax:

If your state levies property taxes, you are obligated to pay those taxes, nevertheless. Failure to do so will result in further fines and penalties. If personal property taxes are not paid on time, the taxpayer will receive a notice in the mail along with a copy of the overdue tax bill, including penalties and interest. If the taxpayer still fails to pay the outstanding tax, the tax authority could go to court and ask for access to the taxpayer’s wages or bank accounts in order to reclaim the money owed. The tax authority can also issue a warrant for the seizure and forced sale of personal property if the situation is extreme.